Glossary of terms

The following terms appear in volumes 1 and 2 of Social Security In 30 Minutes. Visit the Social Security website (at SSA.gov) for more information about specific programs.

Base amounts – A series of IRS thresholds for determining whether you have enough income from Social Security and other sources to trigger tax requirements.

Benefits eligibility screening tool (BEST) – An online tool on the My Social Security web portal (ssa.gov/myaccount) to help determine suitable benefits.

Contribution and benefit base – The maximum taxable earnings level set by the Social Security Administration every year. If your income is above this amount, only the portion up to that level will be subject to Social Security payroll taxes (6.2% for workers and their employers, or 12.4% for the self-employed).

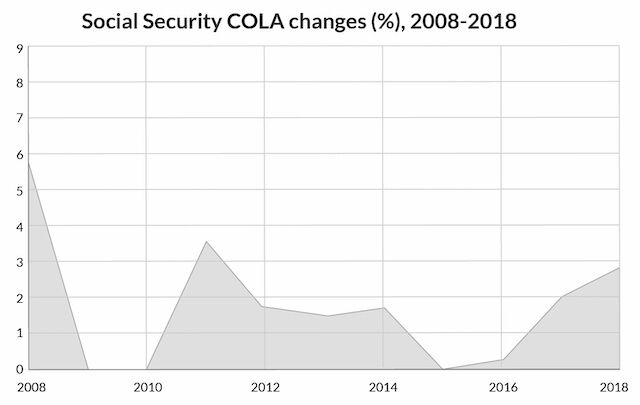

Cost-of-living adjustments (COLAs) – Adjustments made to Social Security benefits, accounting for inflation.

Countable income – The SSA looks at four different types of income to determine the size of monthly SSI payments. Earned income is the money you get for working, including net earnings and self-employment income. Unearned income includes Social Security benefits (including SSDI payments), pensions, unemployment assistance, and interest payments. In-kind income consists of food or shelter provided at a reduced rate or for free. Deemed income comes from people who you live with or can sponsor you, and includes income from a spouse, parents, or roommates.

Coverage threshold – A minimum income level over a three-month period (as of this writing, at least $1,320) required to receive a single retirement work credit.

Deemed filing – When someone born after January 2, 1954 applies for either retirement benefits or spousal benefits they are “deemed” to be applying for both.

Deemed income – The income from you (and spouse), or resources that SSA uses to determine if one has met the resource limit.

Demand letter – Document from the SSA notifying the benefit recipient that he or she has received an overpayment of benefits. The letter will explain the situation and typically demand repayment within 30 days.

Disability – According to the Code of Federal Regulations §404.1505, a disability is defined as “[The] inability to do any substantial gainful activity by reason of any medically determinable physical or mental impairment which can be expected to result in death or which has lasted or can be expected to last for a continuous period of not less than 12 months.”

Disability Determination Services (DDS) – The office responsible for reviewing information and determining one’s qualification as blind or disabled.

Disability Insurance Trust Fund (DI) – The fund from which benefits are paid to eligible disabled people or their spouses/children.

Disabled adult children (DAC) – A former designation within the SSDI benefit program that refers to childhood disability beneficiaries.

Duration test – A test used to determine that an applicant for the SSDI program has enough qualifying years that he or she has worked under the Social Security system.

Earned income – Income from work.

Earned income exclusion – The first $65 of earned income and half of anything over $65 for the month is excluded from consideration when applying for SSI disability benefits.

Earned income limits – Limits placed on the amount of income someone can make who is below full retirement age before a benefit is reduced.

Expedited reinstatement – The process to take if you want to start receiving disability benefits, but worked and had earnings that made you ineligible.

Extended period of eligibility (EPE) – The 36 months after a trial work period in which you either work below substantial gainful activity and get a full benefit, or you work over SGA and do not get one, but are still disabled.

Full retirement age (FRA) – The age you must be to collect your full retirement benefit amount. FRA varies according to when you were born. The SSA also uses the term normal retirement age (NRA).

General income exclusion – The first $20 of your monthly income is excluded from consideration when applying for SSI disability benefits.

Grace period – The three-month period that begins with the month you work over the substantial gainful activity amount and SSA says your disability has “ceased” while in the extended period of eligibility.

Impairment-related work expense (IRWE) – The cost of items or services that someone receiving SSDI or SSI needs in order to work.

In-kind income – Food or shelter that someone else pays for if you are on SSI.

My Social Security – A portal for current and prospective recipients of Social Security benefits. Visit ssa.gov/myaccount to get started.

National average wage index series – Also known as the average wage index, this data serves as a measure of wage trends calculated by the Social Security Administration.

Normal retirement age (NRA) – See full retirement age.

Old-Age and Survivors Insurance Trust Fund (OASI) – The fund from which benefits for eligible retired workers and their spouses/children/survivors are paid.

Payor of last resort – A term used to refer to SSI disability payments, which are always paid last after other options (such as retirement benefits) are tapped.

Plan for Achieving Self-Support (PASS) – For people receiving disability benefits while returning to work, PASS is a written plan with objectives which can allow people to put aside money or purchase equipment needed for employment.

Recent work test – A type of earnings test used to determine eligibility for the SSDI program. The SSA uses the test to determine that an applicant was working, typical of other people in society, and that because of that person’s disability, his or her ability to work declined.

Sequential evaluation – A process used by the SSA to determine the impact of a disability.

Social Security Administration (SSA) – A government agency that administers disability, retirement, and survivors’ benefits.

Social Security Disability Insurance (SSDI) – A benefit that is available to disabled or blind people who have enough work credits to qualify.

Special condition – An earnings situation related to Social Security disability benefits in which someone supports you in doing a job. Special conditions enable deductions to income that may allow recipients to continue receiving disability benefits.

Substantial gainful activity (SGA) – Work that earns a certain amount of money per month—as of this writing, $1,180 per month for non-blind individuals and about $2,000 for people who are blind. Workers meeting the SGA thresholds do not qualify for Social Security disability payments, even if they have medical conditions, injuries, or other physical limitations.

Supplemental Security Income (SSI) – A supplemental program for the blind, disabled, or elderly who also have little to no income and few assets.

Ticket to Work – A free and voluntary program that helps Social Security disability beneficiaries get and maintain employment.

Trial work periods (TWP) – A nine-month period of time in which someone can test the ability to work and still be considered disabled.

Unearned income – Income that you get that is not from work earnings.

Vocational rehabilitation – An individualized program that helps people with disabilities find and maintain work based on their skills and abilities.

Windfall Elimination Provision – A formula that is used to determine benefits if you receive a pension from a job in which you didn’t pay Social Security taxes.

Work activity report – Identifies potential subsidies and special conditions for SSDI and SSI recipients.

Work credits – A system that measures how long you have paid into the system and how much you have contributed, which in turn determines eligibility for receiving Social Security retirement benefits. One credit is equal to a single three-month period in a year, and a total of 40 work credits is required to receive retirement benefits.

Work incentives – A set of rules that allow people who receive disability benefits to continue working and still maintain eligibility.

Work subsidy – The extra amount of wages that an employer pays a disabled or blind employee beyond the actual value of services or work done.